That's why we have this tool that permits you to enter your zip code and also see what policies you can obtain. They do differ rather a little bit from one state to another. What You Need To Contrast, The initial things to know is what you need to contrast when it concerns states - accident.

This is defined per mishap and also covers damages you do to home (not your very own automobile). This is what you insurer will certainly cover for your injuries, as well as is defined each as well as per mishap. This is specified each as well as per crash, as well as covers you if you're associated with a mishap by a without insurance vehicle driver (automobile).

You can also obtain extensive insurance that covers your lorry in occasions like storm damages, burglary, and a lot more - yet states don't need that. Note that the minimums might not be enough for Find more information you. You need to examine your very own individual finance circumstance and also see if you might need extra insurance policy.

If you do not intend to consider it, have a look at, our primary referral for cars and truck insurance policy for university pupils. In about 10 mins you can obtain your insurance policy dealt with online. Look into Allstate here.If you do not drive a lot, think about utilizing among the alternate options we offered (cars).

For protection with this insurer, a high-school student will pay an approximated $429 per month on average. College pupils, on the various other hand, can expect to pay a little bit less for cars and truck insurance coverage.

Motorcycle Insurance Cost For An 18-year-old Things To Know Before You Buy

An additional wonderful alternative for teens, pupils, and also brand-new drivers is telematics. Keep in mind that not all insurance coverage business offer this alternative (auto insurance).

Do not fail to remember to inquire about price cuts for car safety and security functions. That will assist you obtain the most affordable price. You can begin with this device from GEICO.

The ordinary cost of cars and truck insurance in the United States is $2,388 per year or $199 each month, according to data from virtually 100,000 insurance holders from Savvy. The state you reside in, the degree of protection you would certainly such as to have, as well as your gender, age, credit history, and driving background will certainly all factor into your costs (liability).

Vehicle insurance coverage have great deals of relocating components, and your premium, or the expense you'll spend for insurance coverage, is just one of them. Insurance policy is managed at the state degree, and legislations on called for protection and also prices are various in every state. Insurer take into account various variables, including the state as well as location where you live, along with your gender, age, driving background, and also the degree of insurance coverage you wish to have.

auto insurance credit score business insurance insurance company

auto insurance credit score business insurance insurance company

Here are the most significant variables that will certainly influence the rate you'll pay for coverage, and what to consider when checking out your car insurance policy choices. There have actually been some large modifications to car insurance costs throughout the coronavirus pandemic. Some auto insurers are providing discounts as Americans drive much less, and are additionally helping people affected by the infection hold off repayments (suvs).

Hertz - Aaa Discounts & Rewards for Beginners

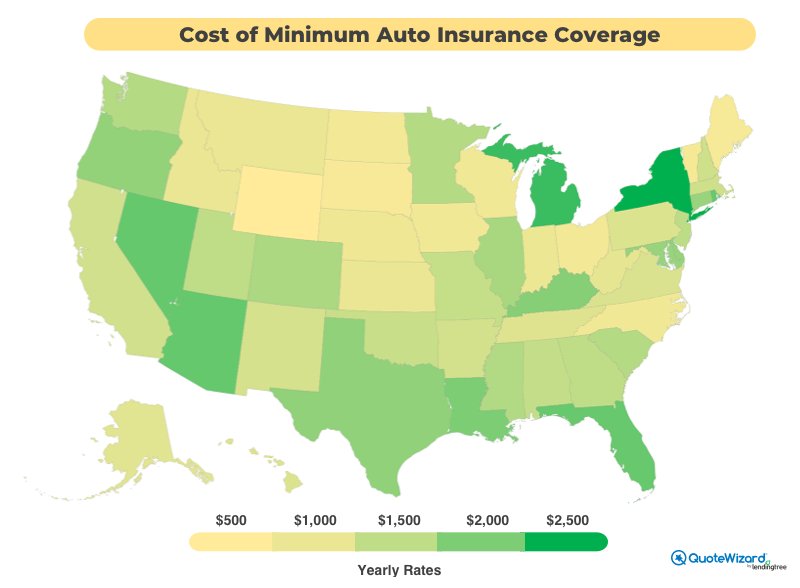

Organization Insider put together a checklist of ordinary automobile insurance coverage rates for each state (cheap). Right here's a variety auto insurance costs by state.

As Well As from Organization Insider's data, auto insurer often tend to charge females extra. Business Insider collected quotes from Allstate as well as State Ranch for fundamental coverage for male and female motorists with a the same account in Austin, Texas - insurance affordable. When swapping out only the gender, the male account was priced quote $1,069 for protection each year, while the female profile was priced quote $1,124 each year for protection, setting you back the female motorist 5% more.

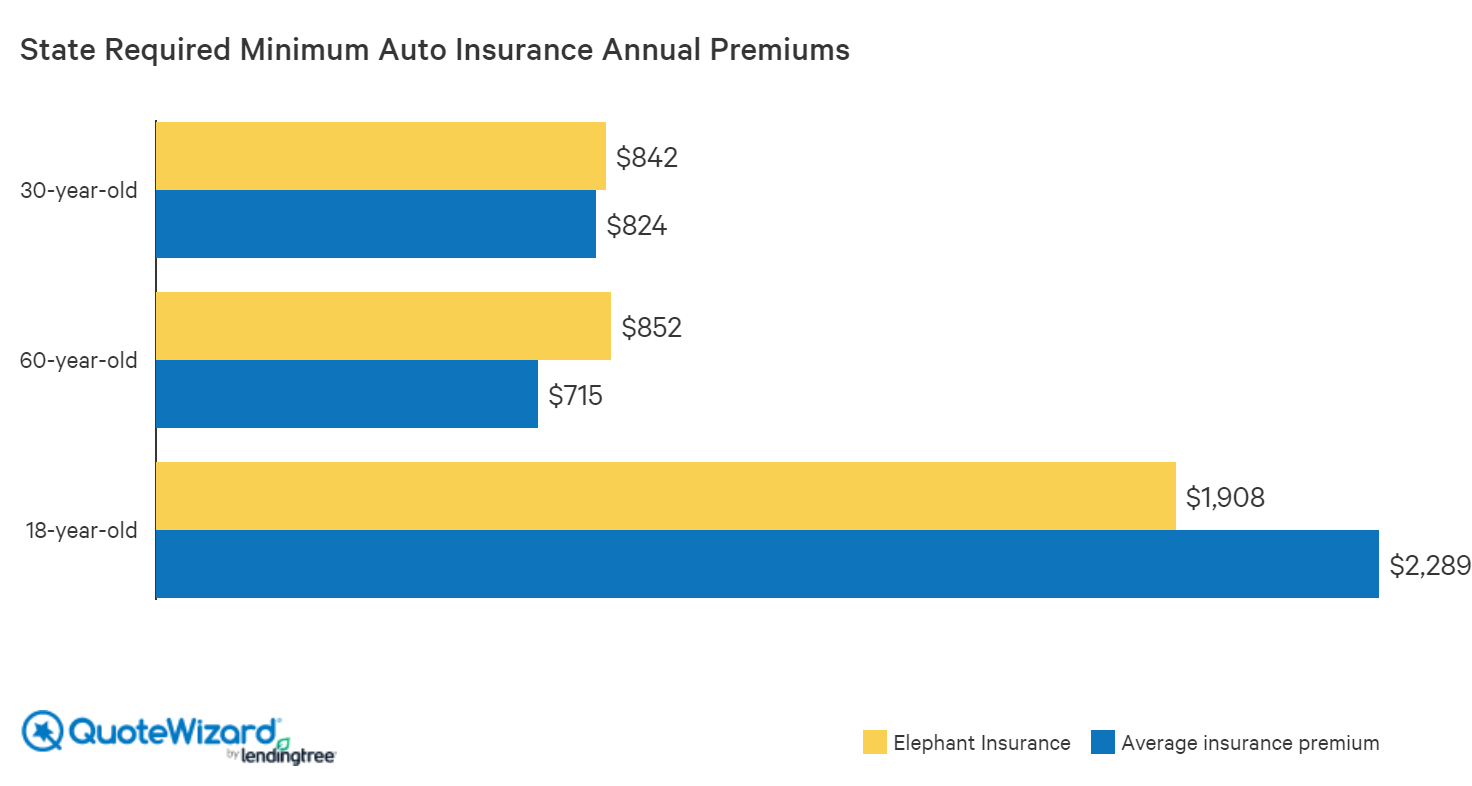

In states where X is a gender option on chauffeur's licenses consisting of Oregon, The golden state, Maine, and quickly New york city insurance providers are still establishing exactly how to compute costs. Typical auto insurance costs by age, The variety of years you have actually been driving will certainly impact the price you'll pay for insurance coverage. While an 18-year-old's insurance policy standards $2,667.

This data was given to Company Expert by Savvy. Just how automobile insurance coverage costs transform with the number of vehicles you possess, Somehow, it's sensible: the much more vehicles you carry your policy, the greater your car insurance coverage costs (car). There are additionally some financial savings when multiple cars are on one plan.

low cost auto auto accident auto insurance

low cost auto auto accident auto insurance

Cars and truck insurance is cheaper in zip codes that are much more country, and also the exact same is real at the state level. Insure. com information shows that Iowa, Idaho, Wisconsin, and also Maine have the least expensive auto insurance of all states, which's since they're extra rural states. Various other variables that can affect the cost of cars and truck insurance coverage There are a few other factors that will add to your costs, consisting of: If you do not drive several miles per year, you're much less most likely to be associated with an accident.

All About Is Applecare+ Worth Buying For Your Iphone? - Consumer ...

Each insurer checks out all of these elements and also rates your insurance coverage in different ways as a result. automobile. It's crucial to compare what you're used. Obtain quotes from several different car insurance provider and also compare them to ensure you're getting the very best offer for you. Personal Finance Reporter.

Much like guaranteeing any various other lorry, insuring a bike costs much more when you're less than 25 years old. If you're 18 years of ages, you can expect the price of insurance to be considerably higher than it would for an older adult. The ordinary motorcycle insurance policy price for an 18-year-old is $998 per year.

These variables include your house state, your driving record, as well as the kind of bike you're riding (cheapest auto insurance). Allow's take a closer look at these expenses, the factors that influence them, and just how you can conserve cash on motorbike insurance coverage. Just How Much Does Motorcycle Insurance Price? The two crucial factors in motorcycle insurance expenses are your age as well as location.

We have actually created numerous of them, so you can better comprehend what enters into recognizing your motorbike insurance policy prices. Coverage Selection One aspect is the type of coverage you purchase - cheap insurance. 49 states require a bare minimum for liability insurance coverage. This will obtain you a less expensive plan, yet it will just cover damages to various other lorries or pedestrians.

To obtain protection for your bike, you'll need crash as well as comprehensive coverage, which can set you back considerably much more. Some companies, like Progressive, supply added strategies like greater injury protection for bicycle riders. insure. An additional insurance coverage choice that influences your price is your insurance deductible. This is the out-of-pocket price you'll pay in the event of a mishap.

Not known Facts About How To Get The Best Car Insurance Rate For Teens And New Drivers

After that again, a greater insurance deductible ways you'll get on the hook for more cash if you enter a crash Location As we already discussed, your location can have a substantial impact on your rate. One of the most crucial element below is the temperature. In colder states, the riding period is shorter, while it can last all year in warmer areas.

cheap car low-cost auto insurance low cost auto vehicle insurance

cheap car low-cost auto insurance low cost auto vehicle insurance

This can likewise have an effect on your prices. Speeding Up as well as Web Traffic Tickets Simply as with automobile insurance policy, your motorbike insurance policy will go up if you have a document of speeding and also other offenses (credit score).

Keep your nose clean for a while, and your prices will go down. Crash and also Claim History If you have actually recently been in a mishap, your insurance coverage prices will go up.

And an insurance quote will not count as a "tough check", so it won't affect your debt rating. Exactly how to Save on Motorbike Insurance The most essential thing to do when getting motorcycle insurance coverage is to compare rates from different companies.

Generally, insurance companies have covered mopeds as well as mobility scooters under their bike insurance policy plans. The average scooter insurance plan cost is concerning $250 per year.

Finding The Cheapest Car Insurance For Teen Drivers for Dummies

Exactly How Much Is Vehicle Insurance Policy each month? Vehicle drivers in the United States invest a standard of $1,251 per year2 on car insurance coverage, making the typical cars and truck insurance coverage expense monthly $104. This typical price is based on a full insurance coverage policy for a driver under 65 years old that has even more than 6 years of driving experience and also a tidy driving document.

We've made a credibility for integrity as well as trust fund, as well as we're proud to have a document of high client ratings for cases services. Aspects Impacting Average Car Insurance Expense per Month Not all drivers coincide, so the typical auto insurance expense differs. If you stay in a location where your danger of remaining in a crash is higher, your insurance prices may be higher. trucks.

Below are a few variables that will certainly affect your insurance policy quotes: Driving history Credit history Age Postal code Automobile Insurance Provider Average Month-to-month Price of Car Insurance Coverage by Automobile Type The type of auto you drive can additionally impact your automobile insurance coverage price. In many cases, vehicle insurance provider might charge much more for insurance coverage on specific kinds of vehicles, including: Owning a vehicle that is typically taken can indicate that your thorough insurance rates are greater.

These kinds of cars are commonly more costly to repair if they are harmed. When it comes to high-end vehicles, they're usually extra costly to change if they're amounted to from an automobile accident (cheap auto insurance). Because these cars can travel at greater rates, people might drive them faster and be more most likely to enter an accident or receive a web traffic offense.

cars perks cheap car insurance cheapest auto insurance

cars perks cheap car insurance cheapest auto insurance

Vehicle drivers under 25 have much less experience when driving and studies reveal they create much more accidents (credit). 3 So, if you or somebody on your policy is under 25 years old, your vehicle insurance coverage premiums may be greater. Automobile insurance coverage rates may reduce after a chauffeur turns 25, particularly if they haven't had any kind of at-fault crashes.

Excitement About Lemonade: Insurance Built For The 21st Century

Typically, if you more than 25 yet below 60 years of ages, your car insurance expense per month will be the most affordable. If you're not within that age range, you can still find means to save. We use several special rates as well as discount rates with the AARP Vehicle Insurance Policy Program from The Hartford.

If you have an AARP subscription, get an automobile insurance coverage quote today as well as conserve. Exactly how Much Is the Typical Cars And Truck Insurance Policy monthly in My State? Car insurance rates vary based on which of the 50 states you reside in. It can be difficult to compare all state car insurance rates.

One state's average automobile insurance expense per month might be greater than one more's since it calls for chauffeurs to have more responsibility protection. On the various other hand, an additional state might average the most affordable auto insurance per month because it needs a lower minimum coverage.